The latest economic downturn is not the only one the world has gone through, it has been rocked by various financial collapes through its long history.

Let's take a look at some economic collapses the world has seen.

Source: Business Insider

...

The Medici Bank

The Medici Bank (1397-1494) was a financial institution created by the Medici family in Italy during the 15th century. It was the largest and most respected bank in Europe during its prime.

There are some estimates that the Medici family was, for a period of time, the wealthiest family in Europe. With this monetary wealth, the family acquired political power initially in Florence, and later in the wider spheres of Italy and Europe.

The bank rose to massive size, leading the family to become heavily involved in Florence's and subsequently many parts of Europe's politics, according to Niall Ferguson's book, The Ascent of Money.

The emergence of politics into the family was eventually one cause of its downfall, as the focus on the bank became less and less, it says.

Eventually, high leverage caused fiscal problems for the bank. With the problems growing, the company defrauded the fund that pays for dowries and was conceded to Charles VIII of France in 1494, according to the book. The entire bank was dissolved.

...

Price revolution

In the second half of the 16th century, Spain began importing silver and gold at a rapid pace from Peru, according to the The Ascent of Money.

Metals were extremely valuable to Spain but relatively unimportant to the natives, and once Spain conquered the natives they put natives into the mines, it says.

The import provided a huge, unexpected supply of silver and gold to Spain and all of Europe, causing massive price inflation. Inflation and high taxes hurt Spanish industry, and much of the country's wealth was subsequently spent on wars, according to the book.

...

Mississippi bubble

In May 1716, the Banque Generale Privee, which developed the use of paper money, was set up by John Law. It was a private bank, but three quarters of the capital consisted of government bills and government accepted notes.

In August 1717, he bought the Mississippi Company to help the French colony in Louisiana. In the same year, Law conceived a joint stock trading company called the Compagnie d Occident (or, The Mississippi Company).

Slowly, the bank began issuing more notes than it could represent in coinage. This led to an economic inflation, which was eventually followed by a bank run when the value of the new paper currency was halved.

The bubble burst at the end of 1720.

...

Overend, Gurney and Company

Overend, Gurney and Company was a London wholesale discount bank, known as "the bankers' bank", which collapsed in 1866 owing about 11 million pounds, equivalent to 981 million pounds at 2008 prices.

The business was founded in 1800 as Richardson, Overend and Company by Thomas Richardson, clerk to a London bill-discounter, and John Overend, chief clerk in the bank of Smith, Payne and Company at Nottingham, with Gurney's Bank supplying the capital.

The bank's core business was the buying and selling of bills of exchange at a discount. It was well respected, and expanded rapidly, reaching a turnover double its competitors combined. For 40 years it was the greatest discounting-house in the world.

During the financial crisis of 1825, the firm was able to make short loans to many other bankers. The house indeed became known as "the bankers' banker", and secured many of the previous clients of the Bank of England.

...

Cotton imports

In the mid-19th century, the Confederate Army in America felt that it needed diplomatic recognition. In order to achieve this status, the army decided to cut off all cotton imports to Europe, according to the book, The Ascent of Money.

Cotton was essential to Europe and it was America's leading export, and the decision ultimately led to a substantially lower amount of revenues, it says.

Inflation also destroyed the value of the Confederate dollar, sinking it from 90 cents compared to the American dollar to less than two cents by the end of the war, says the book.

...

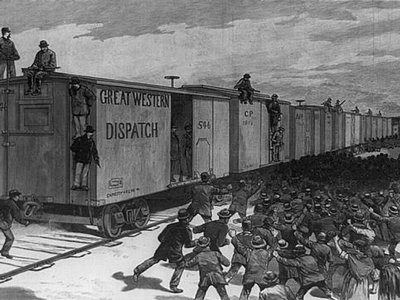

Panic of 1893

The Panic of 1893 was a serious economic depression in the United States that began in 1893. Similar to the Panic of 1873, this panic was marked by the collapse of railroad overbuilding and shaky railroad financing which set off a series of bank failures.

Compounding market overbuilding and the railroad bubble, was a run on the gold supply. The Panic of 1893 was the worst economic depression the United States had ever experienced at the time.

...

Russian revolution

Industries collapsed in Russia and the nation was nearly bankrupt after Wold War One, leading to a surge in strikes and riots throughout Russia, according to the book, The Ascent of Money.

The cause of the economic issues was an overprinting of money to pay for the war deficit. Unemployment surged and wages fell across the board. People even left their own jobs to hunt for food, hurting industries even more, it says.

Russia's national debt was as high as 50 billion rubles, or roughly $2.9 trillion in today's dollars, says the book.

...

The Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in 1930 after the passage of the United States' Smoot-Hawley Tariff bill, and lasted until the late 1930s or middle 1940s.

It was the longest, most widespread, and deepest depression of the 20th century.

...

Fall of the British Empire

Much like many of the previous economic collapses, the British Empire fell due to massive war debts. America loaned the Empire $1 billion of necessary items to assist in its recovery, which was fully paid off in 2006, according to the book, The Ascent of Money.

The Royal Navy was dismantled, and decolonisation occurred at a rapid pace that led to many political issues that still remain today, it says.

...

Housing bubble

The subprime mortgage crisis had a number of different causes, the main cause being mortgage brokers lending more frequently to unqualified home owners than in the past, according to the book, The Ascent of Money.

A factor on top of this was that banks began packaging these loans into bonds, then trading and insuring the newly created mortgage backed securities, it says.

With banks earning large sums from these bonds, the demand rose and mortgage brokers continue to lower their standards and push as many mortgages as they could to put them into the hands of the banks, says the book.

...

Greek sovereign debt crisis

Beginning in late 2009, fears of a sovereign debt crisis developed among investors concerning Greece's ability to meet its debt obligations due to strong increase in government debt levels.

This led to a crisis of confidence, indicated by a widening of bond yield spreads and the cost of risk insurance on credit default swaps compared to the other countries in the eurozone, most importantly Germany.

The downgrading of Greek government debt to junk bond status in April 2010 created alarm in financial markets.