Photographs: Reuters

The deal will improve debt-equity to a manageable level of 3.8 and support its share price, thereby lessening the pain for shareholders.

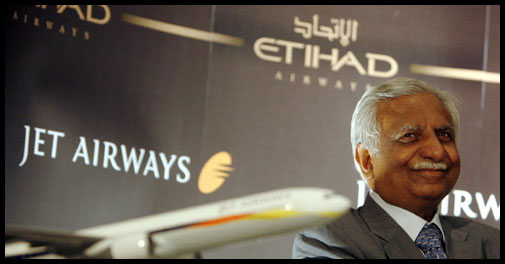

The strategic investment by the Abu Dhabi-based Etihad Airways in Jet Airways could be a game-changer for the latter and its shareholders. According to the deal, Jet will be issuing 27.2 million shares to Etihad for Rs 754.7 apiece totalling Rs 2,060 crore (Rs 20.6 billion).

In the short term, the deal brings much-needed cash and will help Jet improve its debt-laden balance sheet and improve its financial ratios. In the long term, too, the strategic alliance with Etihad will make Jet more competitive in the domestic market as well as on international routes, which now account for 60 per cent of its revenues and operating profits.

Jet's stock, which scaled to its two-year high of Rs 625 levels in December 2012, is thus expected to rule firm on Thursday.

The deal could be a game-changer for Jet. Says Sharan Lillaney of Angel Broking, "The deal is a positive as Jet will be able to refinance its high-cost debt and improve its cash flows. In addition to improving its balance sheet, the company can also look at expansions, both in the domestic as well as international markets."

On the valuations front, the deal implies a market capitalisation to sales of 0.3-0.4 times (and 31 per cent premium to current market price), a decent premium, believe analysts. This could set a benchmark for similar deals in future, says Lillaney.

Click on NEXT for more...

How Jet shareholders stand to gain from Etihad deal

Photographs: Reuters

On the operational front, the deal will convert two competitors into partners and help reduce costs and at the same time expand their network, says Lillaney. Among the smaller areas of co-operation could be parking and landing slots, ground handling and aircraft maintenance.

While asset utilisation could be optimised, the two would also be in a position to offer wider options to their customers. More importantly, an improvement in cash flows also means Jet will be able to bargain for higher discounts on airport charges and fuel.

Oil marketing companies (OMCs) give a cash discount to the tune of 5-10 per cent on aviation turbine fuel (ATF). More, any loans or guarantees from Etihad will also help Jet Airways bring down its costs.

On the business front, the macro environment is also turning positive, with a fall in crude oil prices. Given the 17 per cent fall in crude oil prices since mid-February, expect Jet to benefit given that fuel accounts for 45 per cent of its operating costs.

"Expect airlines to pass on the benefits of fuel price cuts to consumers, which will stimulate flagging demand and help shore up their passenger loads," says an analyst with a domestic brokerage. Passenger demand has been on the decline for six months, forcing all airline companies to launch discount schemes earlier this year, despite the drop in capacity and lower competition on account of grounding of Kingfisher Airlines.

However, post the recent five per cent cut by OMCs last week, analysts expect more cuts next month. In the medium term, analysts expect demand to perk and with prices likely to remain firm, they expect loads and yields to improve.

Click on NEXT for more...

How Jet shareholders stand to gain from Etihad deal

Photographs: Reuters

Jet Airways, which came out with its IPO in 2005 at Rs 1,100 a share, has been quoting below the offer price since early 2006. Despite a 70 per cent rally in the past six months, in anticipation of the deal, the stock is still trading at half of its IPO price (while the Sensex has tripled in value).

A lot of this can be attributed to Jet reporting losses (on a net basis) since FY07, due to the combined effect of poor yields on domestic routes, high fuel prices and interest and depreciation charges on acquiring new aircraft. Between FY06 and FY09, Jet quadrupled its fleet size at a cost of nearly Rs 14,000 crore (Rs 140 billion), largely financed through debt.

This started hurting when air fares in India tumbled and ATF prices soared leading to losses. During the last few years, Jet's debt has been at elevated levels (debt-equity ratio of 11, one of the highest among BSE 500 companies).

Click on NEXT for more...

How Jet shareholders stand to gain from Etihad deal

Photographs: Reuters

While the deal with Etihad might not result in an immediate turnaround in Jet Airways' financial performance, it will improve debt-equity to a manageable level of 3.8 and support its share price, thereby lessening the pain for shareholders. The downside to the deal is the nearly 32 per cent dilution in Jet's equity capital (and in EPS proportionately).

The sting from dilution, though, will be less given that Etihad is acquiring equity in Jet Airways at 31.5 per cent premium to its last closing price of Rs 573. This could spark a rally in Jet's share price on Thursday. The deal price could also become a benchmark if Jet raises further equity in the near term.

The disappointment, however, is that the deal will not result in any open offer for minority shareholders. This may cap any potential short-term rally and also prove to be a dampener for traders who may have built-up positions hoping to tender shares at premium to Etihad.

They may now have to wait for the deal to materialise into operational and financial gains for Jet to make their profits.

More from rediff