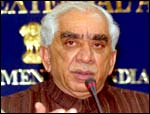

Television channels planning live coverage of Finance Minister Jaswant Singh's maiden Budget speech on February 28 are in for a surprise.

For the past several years, finance ministers have taken close to two hours to complete their Budget speeches. That used to be an advantage.

The longer the Budget speech, the more time the channels get for their experts to deliberate on what the finance minister has planned for the economy and the government's finances.

And that also means the greater the opportunity for inserting more advertisement breaks to rake in more revenue.

But unlike his predecessors, Jaswant Singh wants to keep his speech very short. If you believe his advisors and bureaucrats, the speech would not take more than an hour to finish.

Just like his meetings, his Budget speech would be short and crisp -- no elaborate outlining of the Budget strategy, no wisecracks or quotations from celebrated writers and no detailed listing of the many schemes that most of us forget within days.

A final decision on the structure or the content of the budget speech is yet to be taken.

One question that has not yet been resolved is whether he should stick to the two-part format, Part A containing the strategy, schemes, promises, the revised estimates of revenue and expenditure for the current year, and Part B containing the fireworks -- the tax proposals and the fiscal deficit numbers.

One view within the ministry is that with a shorter speech, the finance minister could well do away with a two-part speech structure. But there are practical problems, point out old-timers in the Budget-making exercise.

Since Part A contains the government's grand schemes and revenue-expenditure plans for the current and the coming years, it can be finalised several days before the Budget.

This leaves enough leeway for Part B to be finalised as late as possible to reflect the last-minute changes in the taxation proposals. Logistically, therefore, there would always be a preference for a two-part speech.

But even if there is no tinkering with the structure, the finance minister seems to be preparing himself to present a much shorter Part B than most of his predecessors.

This follows from a view within the ministry that it is time that the government stopped tinkering with tax rates on different commodities.

Already, a considerable degree of stability has been achieved with respect to individual income tax and corporation tax.

If the proposal to phase out the exemptions is also implemented, the remaining complexities in the direct tax system would also be removed.

So, the logic is now to reduce the complexities in the indirect tax structure so that the tax regime for commodities and services remain stable.

Expect, therefore, the least number of changes in indirect taxes.

There would be no long lists of items whose duties would either go up by 5 per cent or come down by 10 per cent.

Industry associations that have long been used to a patient hearing from the revenue department in response to their specific suggestions for changes in duty rates have already got the message loud and clear.

The prospect of minimal changes in indirect tax rates would also virtually eliminate post-budget lobbying.

If you are looking for the big budget announcements to be made by Jaswant Singh, you might be disappointed.

Singh is not going to make the mistakes of his immediate predecessor by announcing decisions on which his ministry has no control. So, there would be no Budget announcement on labour market reforms or privatisation of companies.

As far as changes in policies under his ministry are concerned, Singh is likely to only talk about what has already been achieved.

His agenda of announcements running up to the presentation of the Budget on February 28 is full.

He has already announced a big move towards capital account convertibility. More announcements on screen-based debt trading and interest rate derivatives trading are in the offing.

Yes, the switchover to the value-added tax system would be a major policy move reserved for February 28.

Implementing the recommendations on direct taxes made by the Kelkar committee would have been another big announcement.

But if you believe bureaucrats in North Block, the Budget will not see any action on the basis of recommendations made by the finance minister's advisor, Vijay Kelkar.

It is certain that in his first Budget, the finance minister will offer substantial concessions to the middle-class.

But much of the goodwill he could earn through those concessions would be lost if he were to implement Kelkar's other recommendations to phase out all tax exemptions and incentives.

So Singh might still go ahead and offer the concessions, but after subjecting Kelkar's report on direct taxes to scrutiny.

So, one more report of an expert committee seems destined to be pushed into the cupboards of North Block.

More from rediff